“I hope my life lessons can benefit you, and lead you to make healthier financial choices, too!”

You may have heard the easiest way to find out what’s important to someone is to check their checkbook. With online banking and many options for electronic payments, I actually only write about ten checks a year. My checkbook only has a very short story to tell! Looking at how I use all my financial resources certainly tells a larger story about me. The details change with time and circumstances, but there is still a common theme in the series of my financial story. First of all, I know God has provided for me, just as He promised in the Bible. Secondly, my decisions on handling what He provides impact my physical, emotional and spiritual well-being.

Have you ever spent money on something and later been very glad you did? Have you ever spent money on something and later regretted that decision? Of

How exactly do we do that? By being thoughtful about our options. In Atul Gawande’s book, Being Mortal—Medicine and What Matters in the End, he explains that perspective matters. He writes about how people of all ages “found living to be a more emotionally satisfying and stable experience” when they recognized life’s fragility. That’s when their focus shifted away from achievement and acquisitions, to everyday pleasures and the people closest to them. Don’t we all want to have an emotionally satisfying life? If keeping our focus on people, on what we already have, and on the fleeting nature of time brings contentment, then let’s make more choices based on that!

It is worth taking your time to think about what is important in the longer view, and then make your financial choice. Such an intentional process is more satisfying and thus a healthier choice. Choose a healthy financial story for yourself!

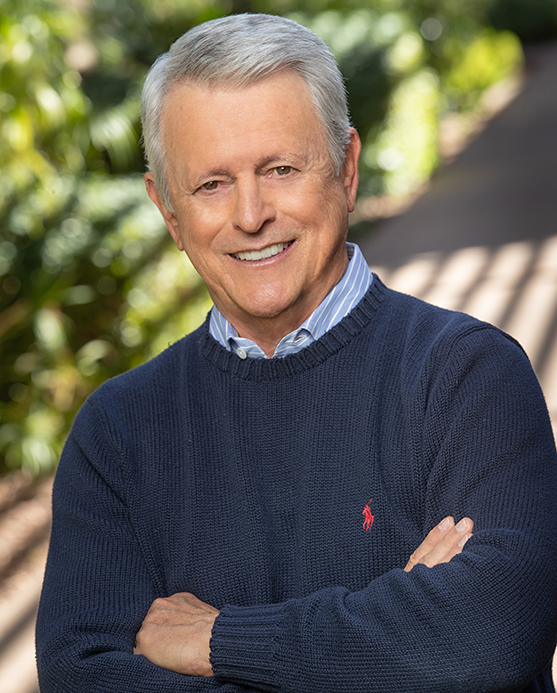

About Deborah Stec, MBA, CPA

Deborah Stec, MBA CPA is TriVita’s Global Controller. She has been with TriVita over twelve years. Her career has been diverse over the decades, from public accounting in New York City, to internal audit in Alaska, to health care management accounting in Michigan, and wellness financial management with TriVita.

Dreborah is the most incedible woman I have ever met. A outstanding asset to Trivita.